Purchase receipt

The purchase receipt is part of the purchase process as illustrated in the Purchasing overview.

On this page you will find the description of the purchase receipt workflow. You can also find more detailed information on the following topics:

- How to create a purchase receipt

- How to create direct purchase receipt lines

- How to create purchase receipt lines from purchase order lines

- How to create a purchase return

This page also includes additional information such as:

- How to manage the stock details status

- How to manage dimensions

- How to view and manage tax details

- How to post a purchase receipt

| Prerequisites | |

|---|---|

| Previous steps |

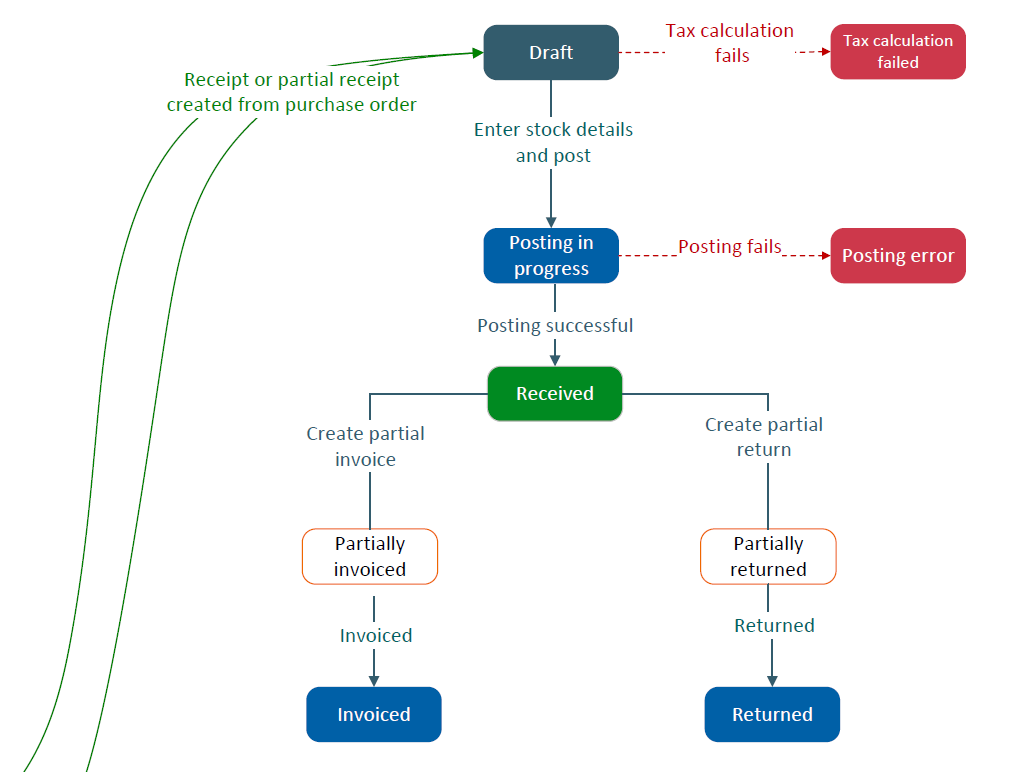

Purchase receipt workflow

This is an overview of the purchase receipt workflow.

- Create the purchase receipt

- Add the lines

- Post the purchase receipt

-

Create a purchase receipt

When you create a purchase receipt, its status is Draft. After entering the header data and at least one line, you save the purchase receipt. The purchase receipt status stays as Draft.

A tax calculation automatically runs. If there is an error, the status changes to Tax calculation failed.

When you correct the tax details, the purchase receipt changes back to Draft.

- Post a purchase receipt

When you enter stock details to post a purchase receipt, its status is Draft.

When you select Post stock, its status is Posting in progress.

-

When you post a receipt and the post fails, the purchase invoice status changes to Posting error. You can try to post it again on the Notification history page.

-

When you post a receipt and it successfully integrates with the relevant financial system, the purchase receipt status changes to Received.

Create a purchase receipt

You can create a purchase receipt with one or several lines for one or several items. Go to the Purchase receipt page and select Create to generate a new purchase receipt and perform the following actions:

- Enter information related to the header such as the purchasing site, the supplier, and the receipt date.

- Enter the lines: You can create direct purchase receipt lines. You can also create purchase receipt lines by selecting purchase order lines.

In the header

- Leave the purchase receipt Number field blank. The number is generated automatically when you create the purchase receipt.

- Enter or select the receiving site.

- Enter or select the supplier.

- The Gross price, Net Price, Total tax, Total excluding tax and Total including tax fields default to the supplier's currency. You can change the currency when you create a direct purchase receipt.

- The Receipt date field defaults to today's date. You can change the date but only to an earlier date.

- You can enter the supplier packing slip number. This information can be used as a matching criterion when selecting the receipt for creating the invoice.

- For traceability reasons, you can enter the carrier's name in the Receiving tab.

Create a direct purchase receipt line

There are 2 ways to create a direct purchase receipt line.

Perform a quick entry

- Select Add line on the Lines grid.

- Enter the Item name, Quantity in purchase unit, Gross price, and other relevant fields.

- Tabulate to validate the information. The main details of the purchase receipt line display in the grid.

- Save.

Add a line with all the detailed information

- Select Add line in panel. The Add new line panel opens.

- Enter or select the Item name, Purchase unit, Quantity in purchase unit, Gross price, and other relevant fields.

- On the Price tab:

- You can enter a Discount percentage and Charge percentage.

- You can check the tax details. Refer to View and manage tax details.

- On the Line notes tab, you can add internal notes. See Add notes.

- To validate your entry and display the line in the purchase receipt list of items, select Apply. To validate your entry and create a new line, select Apply and add new.

- Save. The purchase receipt number generates automatically. The purchase receipt Status field is Draft.

Add notes (optional)

You can add internal notes to a purchase receipt at header level and line level. Internal notes are only for internal purposes.

- You can add notes at the header level from the Notes tab.

- You can also add notes for each line on the Notes tab of the panel used to create the line or edit the line details.

To add notes:

-

From the Notes tab, in the Internal notes text box, enter the notes you want to share with your colleagues.

-

Save.

Create a purchase receipt from purchase order lines

- Select Add lines from orders.

- Select the lines. You can update the quantity to perform a partial order.

- Select Add.

- The selected lines display in the Lines grid.

- Select Stock details from the More actions icon on the line to enter the stock information such as the lot number if the item is lot managed, the serial number if the item is managed by serial numbers, or the expiration date if it is managed. These values apply to the entire quantity. To split the quantity between different stock details, refer to Manage the line stock details.

- To update the quantity and perform a partial receipt: update the Quantity in purchase unit field on the line.

- Select the Completed checkbox when the received quantity does not match the quantity to be received, but you want to complete the line. This can happen in the following situations:

- The received quantity is less than the ordered quantity. Select the checkbox to indicate that the remaining quantity to be received will not be received and to close the purchase order line.ExampleThe order line is for 100 kg of flour. The received quantity is only 99.5 kg. The remaining quantity will not be received.

The received quantity is more than the ordered quantity. Select the checkbox to indicate that the invoice created for the ordered quantity is complete. In this case, the line displays as received and invoiced.

ExampleThe order line is for 100 kg of flour. The received quantity is 100.5 kg. The additional quantity will not be returned and will not be invoiced.

- The received quantity is less than the ordered quantity. Select the checkbox to indicate that the remaining quantity to be received will not be received and to close the purchase order line.

- Save. The purchase receipt number is generated automatically. The purchase receipt Status field is Draft.

Manage the line stock details

When the Status field for the line is Draft, you can define the stock details for the line. You can split the quantity between different locations and different statuses. If the item is lot managed or serial number managed, you can split the quantity between different lot numbers and serial numbers.

- Select Stock details from the More actions icon for the line or from the More actions icon in the Line panel.

- In the Stock receipt detail window, select Add line. A line displays with the stock details defined for the total Quantity.

- Update the quantity and the stock information. You can create a new Lot and Supplier lot number in this window.

- Add as many lines as you need until you have defined the stock information details for the total quantity.

Manage the stock detail status

You can save your purchase receipt when every line in the Stock detail status column in the Lines grid displays Entered or Not required. If any lines display as Required, you need to go back and enter the stock details for the line or complete them if the details in the Stock receipt detail panel are incomplete.

When the status is Entered, the Post stock action appears so you can post the stock movements and progress the receipt.

If a line includes a non-stock managed item, the status displays Not required. You do not need to enter any stock details for this line and are able to post the stock movements and progress the receipt.

View details of a purchase receipt line

The Lines grid displays the main details of the purchase receipt lines. To view all of them, select the Open Line Panel icon. In this panel you can view general information about the line, details about the quantities, and pricing details. Depending on the situation of the line, additional tabs display:

- If the line is created from a purchase order line, the Origin tab displays the situation of the line related to the order line.

- If a purchase return or invoice is created, the Progress tab displays the situation of the return line related to the receipt line.

View and manage tax details

Tax management, tax determination, and tax calculation depend on rules managed by the tax engine used. It can be the Generic tax calculation engine using the internal calculation method, or an external tax engine such as Avalara AvaTax.

This tax engine is defined in the setup of the company associated to the purchase site. It triggers automatically to calculate and determine all the tax details. The determination of tax details is based on information such as: Country and region of the supplier address, country or region of the purchasing address, item tax group, and tax date.

- If you use the internal tax engine, tax amounts automatically calculate and update when you create or edit a line.

- If you use an external tax engine, tax amounts update when you save the purchase receipt creation or update.

When the Not done tax calculation status displays on the General tab, it means the tax calculation has not yet been done by the tax engine and the tax details are not up to date.

When the Failed tax calculation status displays on the General tab and on a line, it means that an error occurred during the tax calculation process, or some tax information such as the tax code is missing. You need to manually enter this information in the Taxes panel associated with the line.

To display and manage the tax details, select Tax details from the More actions icon. You can also select the Open Line Panel icon, go to the Price tab, and select Tax details.

When you create a purchase receipt from the Purchase order page, the tax details flow through to the receipt. These include the Total excluding tax, Total tax, and the Total including tax. The same operation occurs if you create a purchase receipt by interacting with Add lines from order on the Purchase receipt page.

Select Tax details on the line to view the tax rate applied to the purchase receipt and details of how the tax amounts are calculated. You can also change the tax by searching within the Tax field and selecting a different tax rate, this will update the Tax rate and amounts.

Select the Totals tab on the purchase receipt to get a summary of the tax details across all lines for the purchase receipt.

When your purchase receipt has different currencies for the Supplier and Receiving site, 2 additional fields populate on the Price tab on the line and the Totals tab on the Purchase receipt. The Total excluding tax company currency and Total including tax company currency display the tax amounts in the currency of the Receiving site.

Assign dimensions

You can assign dimensions to lines that have a Draft Status field.

You have two options to open the Dimensions window and set dimensions: You can assign dimensions to a line or assign dimensions to several lines.

From the More actions icon on the line, select Dimensions. The Dimensions window displays the dimension types defined for your company.

- You can select a dimension for each dimension type.

- Select OK.

From the More actions icon in the header, select Set dimensions. The Dimensions window displays the dimension types defined for your company.

- You can select a dimension for each dimension type.

-

To assign the selected dimensions to all existing lines that do not yet have assigned dimensions, select Apply to all lines.

To assign the selected dimensions as default values for future lines, select Apply to new lines only.

- Dimensions are managed in the Dimension page.

- Dimension types are managed in the Dimension type page.

Manage dimensions

Purchase receipt lines can inherit dimensions and attributes from the site, supplier, item, or all 3. For this, dimensions and attributes need to be set on the site, supplier, or item record, and default dimension rules need to be set on the company record, on the Dimensions tab. When you create a purchase receipt, the dimensions default on the lines to those defined for the site, supplier, item, or all 3.

If default dimension rules are not set for the company, you can add dimensions directly on the receipt lines. You can add and change dimensions on each line individually. Or you can add or change the dimensions for all lines.

To manage dimensions for individual lines:

- From the More actions icon on the line, select Dimensions.

- Select the dimensions you want for the line.

- Save.

To manage dimensions for all lines:

- From the More actions menu at record level, select Set dimensions.

- Select the necessary dimensions.

- Select Apply to all lines to apply the dimensions to all the existing and future lines or Apply to new lines only to apply the dimensions to future lines only.

Landed cost allocation

When you post a purchase invoice, the landed cost allocation is distributed on the corresponding purchase receipt and purchase receipt lines.

Select Landed costs on the More actions icon on the corresponding line, where you can view the details of the landed costs associated with the corresponding purchase invoices and the total landed cost amount in company currency.

The total landed cost amount for the line is displayed on the Price tab of the Line panel. The total landed cost amount for the receipt is displayed on the Landed costs tab on the receipt alongside individual breakdowns of the different landed cost types.

Edit a purchase receipt line

When you save a purchase receipt, you cannot modify any of the information in the header. You can edit a line only if the Status field is Draft.

You have two options to edit a line:

First option

- Select Open line panel from the More actions icon on the line you want to edit.

- Edit any required fields.

- Select Apply. The panel closes.

- Save.

Second option

- Select the line you want to modify.

- Edit any required fields.

- Tabulate to validate the information.

- Save.

Delete a purchase receipt or a purchase receipt line

You can delete a purchase receipt or a purchase receipt line only when the Status field is Draft.

- To delete a purchase receipt, select the Delete icon from the More actions icon.

- To delete a purchase receipt line, select Delete from the More actions icon on the line you want to delete.

Post to perform the stock journal entry

When you have entered all the requested information and you are ready to perform the stock journal entry, select Post stock. The Status field changes to Received.

Retry a failed posting

If errors occur during the posting process, the document status shows an error. The Posting tab displays details about the error.

You can fix the errors and retry posting, or just retry.

- Select the Retry icon to access the Notification history page.

- For each line with an error, select the More actions icon.

- Select Edit dimensions to fix dimensions or the supplier invoice number for purchase invoices or credit memos, if needed.

- Or select Retry to retry the operation. This can be necessary, for example, if you integrate with Sage Intacct and you fixed an account in Sage Intacct.

- Use the Search button to check if the record was processed successfully. The operation can take some time to process.

- Close the Notification history window to go back to the original document.

View the purchase receipt line and purchase order line progress

To check the situation of the purchase receipt line related to the purchase order line, select the line to open the detail panel. The Progress tab displays the following information:

- The purchase order number

- The purchase order line status

- The quantity in sales unit

- The available quantity to receive

Create a purchase return

You can create a complete purchase return or a partial purchase return.

Create a complete purchase return

The entire purchase receipt can be returned when the Status field of the purchase receipt is Invoiced or Received.

To create a complete purchase return, select Create return.

- The Status field of the purchase receipt changes to Returned.

- The Return status of the purchase receipt changes from Not returned to Returned. The Return status field displays on the Return tab of the Line panel.

- The Status field of the purchase receipt lines changes to Closed.

Create a partial purchase return

To create a partial return, go to the Purchase return page and select the Add lines from receipts action.

- You can select some of the purchase receipt lines. On the selected lines, you can change the quantity to be returned for a quantity less than the received quantity. As a result, the Return status field on these receipt lines changes to Partially returned. The Status field on the receipt and on the partially returned lines changes to In progress.

- When the lines are completely returned, the Return status field on these receipt lines changes from Not returned to Returned.

- If only some of the lines are returned, the Return status field on the receipt changes from Not returned to Partially returned and the Status field changes from Pending to In progress.

- When the received quantity on a receipt line is fully returned, the purchase receipt Status changes to Returned. The Status field on the purchase receipt lines changes to Closed.

View the purchase return line and purchase receipt line progress

After you create the purchase return, you can check and have a global view of the situation of the purchase receipt line related to the purchase return line.

Select the line to open the detail panel. The Progress tab displays the main return information:

- The return status

- The purchase return status

- The returned quantity in purchase unit for each purchase return line

View the purchase invoice line and purchase receipt line progress

To create a full or a partial invoice for the receipt, go to the Purchase invoice page.

After you create the purchase invoice related to the purchase receipt, you can check the Invoice status for the purchase receipt in the Financial tab. This status changes according to the situation of the receipt lines related to the invoice.

The invoice status for the receipt line displays in the Progress tab in the Line panel.

- When a line is partially invoiced, the Invoice status field on the line and on the receipt changes from Not invoiced to Partially invoiced. The Status field on the receipt is Partially invoiced and the Status on the receipt line is In progress.

- When the received quantity on a line is fully invoiced, the Invoice status field on the line changes from Not invoiced or from Partially invoiced to Invoiced. The Status field on the purchase receipt line changes to Closed.

- When all the lines are fully invoiced, the Status field on the receipt changes to Invoiced.

The Closed status on a receipt line is also linked to the situation of the line related to the return. The Status of a line can be Closed even if it is partially invoiced: this happens when the line is also partially returned and there is consistency between the returned quantities and the invoiced quantities.

The quantity on the receipt line is 100. The line is closed if the returned quantity is 20 and the invoiced quantity is 80.

Working with purchase receipts

Refer to the list of questions in this section for guidance on how to use your Sage Distribution and Manufacturing Operations solution to carry out day-to-day sales tasks.

I cannot save the purchase receipt and there is control on the Supplier field.

I cannot save the purchase receipt and there is control on the Supplier field.

You cannot select a supplier that was created from a business entity whose site belongs to the same legal company as the receiving site. This would cause billing issues. This supplier type is used for stock transfer purposes only, as the shipping site.