Sales credit memo

When a sales invoice is posted, you can create a credit memo from the invoice, or from a return request if it requires a credit memo.

The sales credit memo is part of the sales process as illustrated in Sales overview.

On this page you can find the description of the sales credit memo workflow. You can also find more detailed information about the following topics:

- How to create a sales credit memo

- How to manage the tax information

- How to manage analytical dimensions

- What are the options available on the lines

- How to add notes

- How to post the sales credit memo

- How to print a sales credit memo

- How to send the sales credit memo

- How to edit a sales credit memo

- How to delete a sales credit memo

| Prerequisites |

Sales return request (optional) Sales return receipt (optional) |

|---|---|

| Previous steps |

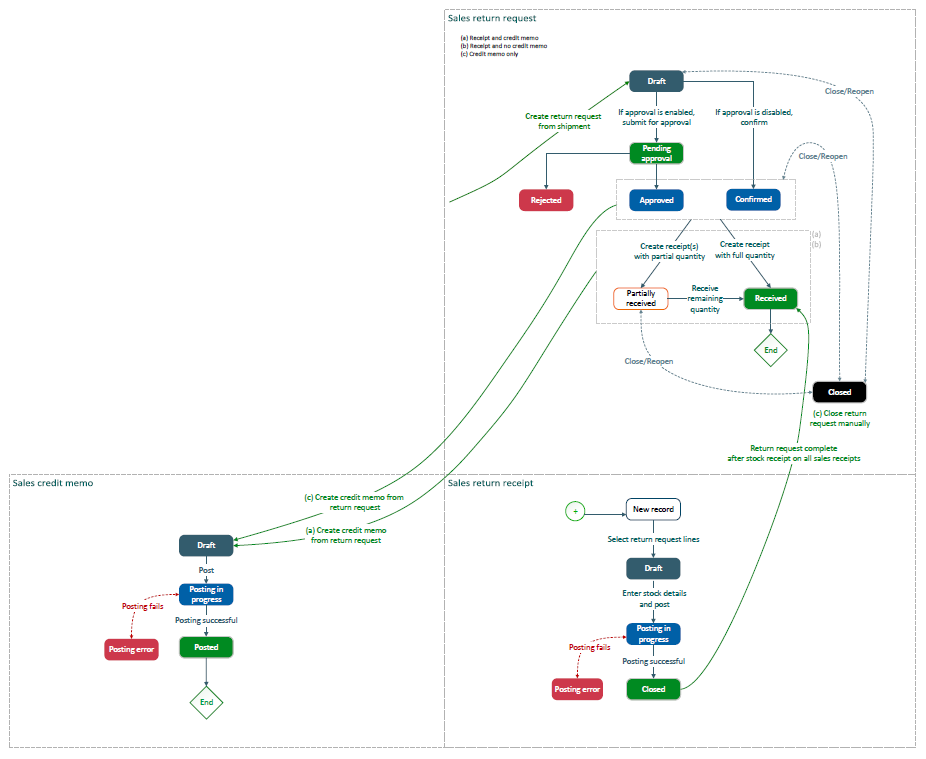

Sales credit memo flow

This is an overview of the sales credit memo workflow, including the sales return request and sales return receipt workflows because they are closely linked (opens new window, PDF, 0.15MB).

These 3 images are a breakdown of the overview above.

The sales return request flow

The sales return receipt flow

The sales credit memo flow

- Create the credit memo from an invoice or from a return request.

- Post the credit memo.

The sales credit memo flow in detail

-

Create the sales credit memo.

-

From a sales invoice

-

From a sales return request when the return request reason is Receipt and credit memo, and as soon as one of the return receipt linked to the return request is posted

-

From a sales return request when the return request reason is Credit memo only, as soon as the return request is approved or confirmed

The credit memo is created with status Draft.

-

-

Post the credit memo

When the posting fails, the credit memo status changes to Posting error. You can go to the Posting tab for details about the posting and the error.

When the posting is successful, the credit memo status changes to Posted and the flow stops.

Create a sales credit memo

-

When there is no return request, to create a sales credit memo, select Credit on the invoice.

-

When there is a return request with a return receipt, you can create a credit memo by selecting Credit on the return request as soon as the return receipt is posted. If there are several return receipts, as soon as one return receipt is posted, you can create a credit memo to credit the quantity for this return receipt.

-

When there is a return request with no return receipt but a credit memo only, you can create a credit memo by selecting Credit on the return request as soon as the return request is approved or confirmed.

The system creates the credit memo. All information defaults to the invoice. You can edit some fields.

-

If sequence number rules are defined for the sales credit memos on the Sequence number assignment page, the sales credit memo number populates automatically when you save the credit memo for the first time.

For France and South Africa, you can define rules to generate a creation number for the credit memo draft, replaced by a final number when posting the credit memo.Otherwise, enter the number manually.

- You can edit the credit memo date and the bill-to address if needed.

- Enter the credit memo payment due date.

- You can enter the credit memo reason.

- On each line, you can edit the quantity to credit and prices.

- From the More actions menu, select Open line panel.

- Enter the quantity of items that need to be credited and modify prices if needed.

Manage the tax information

Tax related information is displayed on the Totals tab.

- The first block displays the tax amount, excluding tax amount, and including tax amount accumulated for all the credit memo lines.

- The Summary by tax block displays the total taxable base and amount, per tax and tax rate. For example:

- All the credit memo lines whose tax is Normal rate collected on debits are summed up on one line.

- All the credit memo lines whose tax is Reduced rate deductible on debits are summed up on another line.

-

The Amounts in company currency block displays the excluding and including tax amounts in the company currency.

The company is the company of the sales site.

Manage analytical dimensions

Dimensions and attributes are inherited from the sales invoice lines. You can modify the dimensions, or add dimensions if there are not any, for all lines. Or you can manage the dimensions on each line.

To manage dimensions for all lines:

- From the More actions menu at record level, select Set dimensions.

- Select Apply to all lines to apply those new settings to all the existing and future lines or Apply to new lines only to apply those new settings to future lines only.

To manage dimensions for individual lines:

- From the More actions icon on the line, select Dimensions.

- Select the dimensions you want for the line.

- Save.

Options on the lines

The Lines grid displays the main information for the sales credit memo lines.

To view all the details of a line, select Open line panel from the More actions icon. In this panel, you can view general information about the line and details about the quantities. There is a link to the sales return request or invoice record.

You can edit a line when the credit memo status is Draft.

After the credit memo is posted, you cannot delete lines.

To delete a line, from the More actions menu, select Delete.

- From the More actions icon, select Dimensions.

- Enter the necessary information in the Dimensions panel and select OK.

You can manage the line analytical dimensions when the credit memo status is Draft.

- From the More actions icon, select Tax details.

- Edit the tax and select OK.

You can modify the tax for a category in case of a particular context for a line.

Add notes

You can manage internal and customer notes on a sales credit memo, at the document or line level, or both.

Internal notes are notes you want to share with your colleagues. Customers never see these notes. There are for internal purposes only. But you can add notes in the Customer notes text box. These notes display on the PDF sales credit memo for the customer's information.

You can manage notes at the document level from the Notes tab.

If Add notes to customer document is switched on, the customer notes print on the last page of the PDF credit memo.

-

Repeated from the sales invoice

When the sales credit memo is created from a sales invoice, the invoice notes are repeated on the credit memo if Repeat the document notes on new documents. is switched on for the invoice.

You can still update notes repeated from the invoice if needed.

-

Repeated from a sales return request

When the sales credit memo is created from a sales return request, the return request notes are repeated on the credit memo if Repeat the document notes on new documents. is switched on for the return request.

You can still update notes repeated from the return request if needed.

You can manage notes for a line from the Line notes tab of the line detail panel.

If Add notes to customer document is switched on, the customer notes added for a line print under the corresponding line on the PDF sales credit memo.

-

Repeated from the sales invoice

When the sales credit memo is created from an invoice, the invoice line notes are repeated on the corresponding credit memo lines if Repeat all the line notes on new documents. is switched on for the sales invoice.

You can still update notes repeated from the invoice if needed.

-

Repeated from a sales return request

When the sales credit memo is created from a sales return request, the return request line notes are repeated on the corresponding credit memo lines if Repeat all the line notes on new documents. is switched on for the return request.

You can still update notes repeated from the return request if needed.

Post the sales credit memo

After you enter all details, you need to select Post to start the posting.

The sales credit memo status changes to Posting in progress.

- If there are posting errors, the credit memo status changes to Error. You can go to the Posting tab and refer to the diagnoses to know more about the errors.

- If there's no error, the credit memo status changes to Posted.

Retry a failed posting

If errors occur during the posting process, the document status shows an error. The Posting tab displays details about the error.

You can fix the errors and retry posting, or just retry.

- Select the Retry icon to access the Notification history page.

- For each line with an error, select the More actions icon.

- Select Edit dimensions to fix dimensions or the supplier invoice number for purchase invoices or credit memos, if needed.

- Or select Retry to retry the operation. This can be necessary, for example, if you integrate with Sage Intacct and you fixed an account in Sage Intacct.

- Use the Search button to check if the record was processed successfully. The operation can take some time to process.

- Close the Notification history window to go back to the original document.

Print a sales credit memo

You can print the credit memo draft, or the credit memo when it is posted.

-

Select Print.

-

You can print or download the PDF document.

The Printed checkbox on the Information tab is selected when you print a posted credit memo. There's no indication for a credit memo draft being printed.

Send the sales credit memo

You can use the automatic email sending system to send a posted sales credit memo to the customer or any recipient.

-

Select Send.

-

Enter the recipient information.

-

Select Send again.

The email with the PDF document is automatically sent to your recipient.

The Sent checkbox on the Information tab is selected when you send the posted credit memo to a recipient through the automatic email sending system. If you send the printed document by email, not by using the automatic email sending system, the Sent checkbox is not selected.

Edit a sales credit memo

When the credit memo is at status Draft, you can edit some fields at document and line level.

You cannot add lines directly to the grid. Lines come from an invoice or a return request.

You can no longer edit a credit memo when it's posted.

Delete a sales credit memo

You can delete a sales credit memo that is not posted yet.

Working with sales credit memos

What is the difference between the credit memo number and the creation number?

What is the difference between the credit memo number and the creation number?

When you create the credit memo, the values in the Number field and in the Creation number field are the same. This number remains the same when you post the invoice, except for some legislations that have specific legal requirements. For example, according to the French and the South African legislations, sales credit memos need to have a chronological and sequential number when they are posted. To manage this requirement, you need to assign two sequence numbers to the credit memo type document. The first one is used when you create the credit memo, to generate the number displayed in the Creation number field. This number is also displayed in the document Number field until you post the credit memo. When you post the credit memo, the second sequence number is used to generate the final credit memo number displayed in the Number field. The original number always remains in the Creation number field. Refer to the Sequence number assignment documentation for detailed information.